Talking Concepts

December 2023

INTEREST RATES

Interest Rates that start from…

5.89% p/a Variable Rate

5.91% p/a Comparison Rate

Based on our lender panel, Auswide Bank’s Variable Rate, provides the most competitive Interest Rate. Interest rates are correct as at 05/12/2023 and subject to change at anytime. The comparison rate is based on a loan amount of $250,000, over a 30 year term. WARNING: This comparison rate is true only for the example given and may not include all fees and charges. Different terms, fees and other loan amounts might result in a different comparison rate. Terms, conditions, fees and charges apply and your full financial situation would need to be reviewed prior to acceptance of any offer or product.

Dates to Remember

21 December 2023 – Monthly BAS – November lodgement and payment due

21 December 2023 – Office closes for Christmas break

10th January 2024 – Office re-opens

15th January 2024 – December 2023 Payroll Tax (Date extended, normally due 7th)

28th January 2024 – December Quarterly Super Due

ATO MyGov Account

Source: ato.gov.au

By linking your myGov account to the ATO, you can manage your tax and super affairs whenever it suits you.

In ATO online services you can lodge and check the progress of your income tax return as well as update your personal details, keep track of your super and arrange to pay a debt.

To link your myGov to the ATO:

- Sign in to your myGov account.

- Select View and link services on the myGov home page.

- Under Link a service heading, select Link next to Australian Taxation Office.

- Select I agree to the terms and conditions of use.

- Enter or confirm your personal details.

- Answer 2 questions about your tax record.

- Select I agree to verifying and linking my record.

If you attempt to answer 2 questions but don’t have the required information to link, a linking code option will appear. You’ll need to phone the ATO to get a unique linking code. The ATO will need to ask you questions to prove who you are. This is to protect the privacy of your account.

C&R Update

Concepts & Results Group supports flexible working arrangements, and while our team mostly

work remotely, they are still available to take your calls 8.30am to 5pm Monday to Thursday and 8am to 4pm Friday.

Our office at 612 Warrigal Road Malvern East is usually open at least twice a week, but it is a good idea to call and make an appointment or confirm that someone is in the office.

Some of our team members may send you an email outside our normal working hours, as this may be convenient for them, but it is not expected that you read, respond or follow up on this email outside your hours of work.

CHRISTMAS CRACKER JOKES

What do you call a boomerang that does not come back?

A stick!

Which type of athlete is warmest in summer?

A long jumper!

Who hides in the bakery at Christmas?

A mince spy!

Why is Estimation Important in Construction?

Source: Tuan Duong, DuoTax

https://duotax.com.au/insights/why-is-construction-estimation-important/

Part 1

Understanding why estimation is important in construction takes us to the heart of successful project management. It’s more than just crunching numbers; it’s about aligning resources, managing expectations, and ensuring that projects are delivered on time and within budget.

So, here’s why you should consider getting an estimation before your next project.

What are Construction Cost Estimations?

Construction estimation is the process of predicting the probable costs associated with a construction project. These costs may include labour, materials, equipment, and other expenditures that are likely to be incurred during the project lifecycle.

Through accurate cost estimates, contractors and construction companies can provide clients with a realistic and accurate projection of the costs, helping them budget accurately, control expenditures, and ensure the project’s financial feasibility.

The Significance of Estimation in a Construction Project

Now that you know what cost estimates are, here are some reasons why you should consider getting one during the construction process.

Enables Accurate Budgeting

An accurate construction estimate allows you to allocate funds appropriately, ensuring sufficient resources are available throughout the project’s duration. This helps prevent financial difficulties that could stall progress and lead to project failure.

Facilitates Comparison of Bids

Accurate estimates provide a basis for comparing bids from different contractors. You can then evaluate the cost-effectiveness of each offer and choose the most suitable one, considering their budget and project requirements.

Supports Project Planning and Management

Estimation is not just about cost. It also provides a roadmap for the project, outlining the resources required, the timeline, and the sequence of tasks. This aids in efficient project planning and management, ensuring timely and successful completion.

Enhances Communication and Transparency

Detailed construction cost estimators enhance communication between you and the contractors. It provides a clear picture of what to expect, reducing the chances of misunderstandings or disputes.

Helps in Risk Management

Construction projects are fraught with risks, including cost overruns, delays, and resource shortages. Accurate estimation can help identify potential risks and develop mitigation strategies, contributing to effective risk management.

The Role of Construction Cost Estimation in Project Management

Beyond being valuable for the client who ends up having to fit the bill, construction cost estimating services also play an important role in managing the overall construction projection.

Determines Project Feasibility

One of the primary reasons why construction estimating is important in construction is that it determines the project’s feasibility. It allows companies to assess whether the proposed project can be completed within the client’s budget and timeframe.

Aids in Decision Making

An accurate estimate provides valuable data that aids in decision-making processes. It helps project managers allocate resources efficiently, schedule tasks optimally, and manage risks effectively.

Enhances Project Control

Accurate estimation enhances control over the project. By providing a detailed picture of the costs, timeline, and resources needed, it allows project managers in a construction company to monitor progress effectively and take corrective actions when necessary.

Different Types of Construction Estimates:

Service Type | Description | For |

Council Report, Section 94 Contribution | It estimates construction costs and facilitates the council’s calculation of your monetary development contribution levy. | Developers and Architects |

Bill of Quantities | A detailed report that navigates the complexities of projects in the construction industry, providing a keen eye for detail and a deep understanding of costs | Developers, Builders, Contractors and Architects |

Initial Cost Report | A fundamental requirement for securing a construction loan is providing banks and financial institutions with an understanding of the financial landscape of proposed developments. | Developers and Lenders |

Progress Claim Construction Report | A detailed report to accelerate your build with progress claim construction | Developers and Lenders |

Insurance Replacement Valuation Report | A comprehensive report that assesses the accurate replacement cost, or sum insured, of a building—be it commercial or residential—in the event of any loss or damage | Developers, Insurance Brokers and Strata Committees |

Elemental Cost Plan (Preliminary Cost Report) | A detailed elemental cost plan to assess feasibility and achieve better value for your upcoming construction project. | Developers and Architects |

Part 2

Insights into the Challenges in Construction Estimation

Challenge 1: Navigating Inaccurate Data

Inaccurate data, stemming from outdated material prices or underestimated labour costs, can significantly impact the overall budget and timeline of a project.

A robust data management system that ensures regular updates of all cost elements can mitigate this.

Employing a dedicated team or individual to manage, validate, and update the data repository ensures that estimators are always working with the most accurate and current information, thereby enhancing the reliability of the estimates provided.

Challenge 2: Addressing Volatile Material Prices

The fluctuating prices of materials in the construction industry can pose a significant challenge, especially for long-term projects. Adopting a dynamic pricing strategy that includes clauses in contracts to accommodate price variations can be beneficial.

Additionally, leveraging technology to track real-time material price changes and adjusting estimates and budgets accordingly ensures that financial planning remains agile and realistic, safeguarding the project against unexpected financial strains.

Challenge 3: Managing Labour Cost Variability

Variability in labour costs due to factors like regional wage differences or labour shortages can skew estimation accuracy. Establishing a comprehensive labour cost management strategy, which includes periodic market analysis and labour cost forecasting, can mitigate this.

Incorporating buffer amounts to accommodate unexpected hikes in labour costs and engaging in fixed-rate contracts where possible may also provide stability and predictability in financial planning.

Challenge 4: Overcoming Technological Limitations

Lack of access to or knowledge of advanced estimation software can hinder the accuracy and efficiency of estimations.

Investing in technology and training is crucial.

For example, adopting advanced estimation software and ensuring that the team is adept at utilising these tools effectively can significantly enhance estimation accuracy and efficiency, reducing the likelihood of human error and ensuring that estimates are developed based on the most accurate and reliable data available.

Challenge 5: Estimating for Complex Project Requirements

Unique or complex projects may involve specialised materials, unconventional construction methods, or specific regulatory compliance, making estimation challenging. Engaging specialists for such projects who bring in-depth knowledge of specific construction methodologies and materials can enhance estimation accuracy.

Collaborating with specialised subcontractors or consultants and incorporating their insights into the estimation process ensures that all unique elements are adequately accounted for, providing a comprehensive view of the financial requirements of the project.

Challenge 6: Ensuring Regulatory and Compliance Adherence

Navigating through various local, state, and federal regulations and ensuring that all aspects of the construction project are compliant can be a complex task. Engaging legal experts or consultants who specialise in construction law and regulations can ensure that estimates are compliant with all relevant laws and standards.

Utilising software that can integrate regulatory costs and requirements into estimates can also streamline compliance management, ensuring that all regulatory aspects are considered in the financial planning of the project.

Key Takeaways

- Accurate construction estimation is pivotal for aligning resources, managing budgets, and ensuring timely project completion.

- Various types of cost estimations, such as Bill of Quantities and Elemental Cost Plans, cater to different needs and stakeholders in a project.

- Addressing challenges like managing volatile material prices and ensuring regulatory compliance is crucial for maintaining the accuracy and reliability of estimates.

If you would like to find out more about how Duo Tax can help with your next construction cost estimation report, call DuoTax on 1300 185 498 or our office on 9569 5676.

Disclaimer: Please note that every effort has been made to ensure that the information provided in this guide is accurate. You should note, however, that the information is intended as a guide only, providing an overview of general information available to property investors. This guide is not intended to be an exhaustive source of information and should not be seen to constitute legal or tax advice. You should, where necessary, seek a second professional opinion for any legal or tax issues raised in your investing affairs.

The evolution of AI (Artificial Intelligence)

Source: Accountancy insurance.com.au

Until recently, identifying scams was a breeze, thanks to hackers’ often poor grammar and spelling. However, the game has changed with the advent of chatGPT, propelling cybercrime to new heights by enhancing the sophistication of phishing emails through impeccable language skills.

This shift has given scammers a powerful tool to exploit, particularly in the realms of phishing, business email compromise, and voice scams, allowing them to convincingly impersonate individuals.

Taking it a step further, WorkGPT emerges as a specialised tool for hackers, tailored for crafting phishing emails with a chosen tone—be it friendly or business-like.

The implications of such tools in the wrong hands underscore the pressing need for heightened cybersecurity measures in today’s evolving digital landscape.

An office space evolution

Source: Cromwell Funds Management

We know the office space landscape is changing. It’s up to real estate investors and fund managers, to a listen to the modern requirements of tenants and invest in upgrading assets to meet these needs while also adding value for investors.

Cromwell’s Research Investment Strategy Manager, Colin Mackay, examined how the office is increasingly becoming a place for collaboration and social connection, rather than focus work, meaning a greater need for meeting, gathering, and collaboration spaces. There is also a need to lower density and make workplaces more comfortable from an employee wellbeing and retention perspective.

Earlier this year, Insight examined ‘The physical office in a hybrid world’ – how white-collar employees divide their working week between home and office, and how the role of the office space has changed forever, largely due to work from home requirements during the COVID-19 pandemic.

The conclusion reached was that, as demand continues to concentrate on the minority of space suitable for modern occupation, the supply-demand mismatch will widen. It was proposed that investors who own or can acquire or create the space occupiers want, where they want it, are well positioned for future rental growth – and, importantly, are more likely to retain and attract tenants.

So, what do tenants want? Spaces occupies want.

Understandably, tenant requirements can be as diverse as the building occupiers themselves. However, there are a number of reoccurring modern office space requirements that require attention.

A May 2023 research paper by global real estate services firm JLL revealed that incentives being offered by landlords to either encourage tenants to stay, or entice them to new premises, remain at historically high levels across many markets.

According to the research, upgrades to the base building, including end-of-trip facilities, improved ground entry and reception areas, improved lifts and amenities, event spaces, health and wellbeing facilities, business lounges, and cafes are high on the agenda for landlords seeking to keep their occupancy levels stable.

Sustainability is also increasingly a consideration for tenants, including requirements to source all power from renewable sources, or undertake capital upgrade works to the building infrastructure.

In addition, research from Swinburne University of Technology and Third-Place.org in January announced that “working from cafes and pubs will be a 2023-defining trend”2. These kinds of work environments have been termed ‘third spaces’ – or ‘third places’.

That is, if ‘home’ is categorised as a ‘first space’, and the traditional office workplace is categorised as a ‘second space’, ‘third spaces’ can be best described as communal, multi-purpose areas that people can utilise as they desire – including for work. The desire for third spaces has increased significantly since the end of the COVID-19 pandemic, as office building owners and employers look for ways to encourage more workers to return to the office.

The Swinburne-Third-Place research found that almost half of remote workers now spend time each week working from cafes or other third places. The trend continues to be particularly popular with Gen Z workers (loosely defined as people born between 1995 and 2010), ten percent of whom say third places are now their preferred place to work.

The researchers found that, on average, people who work in third places will typically do so between two and three times each week. These workers will stay anywhere between 15 minutes and four hours – most of the time, they’ll go to a third place on their own.

The top three benefits to working in a third place were reported to be mental reset, community and social connection, and great food and coffee. When asked to what extent working from a third place positively contributes to their overall wellbeing, the average response was 86%. By extension, 98% of respondents said they’d continue to use a third place for work in the future.

ALI Insurance Protection

We like to ensure our client’s have thought about how they would cover their loan repayments should anything happen to them. It is an important consideration we take very seriously as we want to ensure our client’s are protected against those unforeseen events life sometimes throws at us.

For a small monthly premium (that could be offset by ALI’s extra benefit savings as detailed below), this insurance provides our clients with a unique living benefits cover which provides a pay-out should they suffer from a serious medical condition that is not terminal (such as cancer or a stroke).

We have firsthand experience on the benefits of this cover with one of our own clients receiving a payout within 15 days of submitting her claim when she found out she had bowel cancer (which was months faster than the payment she received from the insurance in her super).

This was life changing for her as it meant she could take time off work to focus on her health and recovery and alleviated the financial stress on her young family.

My Protection Plan policyholders also automatically get exclusive access to ALI’s everyday savings program, Extra Benefits. It provides a discount of 7.5%* for Coles and Woolworths, which on a $1,000 monthly grocery spend means a saving of $75 each month.

With close to 100 retailers, including fuel, electronics, fashion and homewares stores, the savings can really add up. Our client’s can use ALI’s handy calculator here to work out how much they can save which will help offset their premium should they wish to take out a My Protection Plan.

RATE HIKE REPRIEVE FOR DECEMBER

In December, big bank economists predict the Reserve Bank of Australia (RBA) will keep interest rates at 4.35%. The RBA raised rates in November, citing inflation concerns. Recent Consumer Price Index data showed inflation at 4.9%, but experts expect the RBA to maintain rates in December due to weak consumer spending and rising unemployment. The Commonwealth Bank of Australia sees little chance of a rate hike, emphasising the RBA’s data-dependent approach. While markets assign a 3% chance of a December rate increase, economists suggest February might be more likely if inflation surprises positively. Westpac echoes the sentiment, indicating February is live for a rate hike if inflation exceeds expectations. However, if economic conditions align with forecasts, a steady cash rate in December is deemed more probable.

Electronic Signing

At Concepts & Results we ask you to sign documents electronically whenever possible. This can be via Xero, Docusign, or Adobe sign.

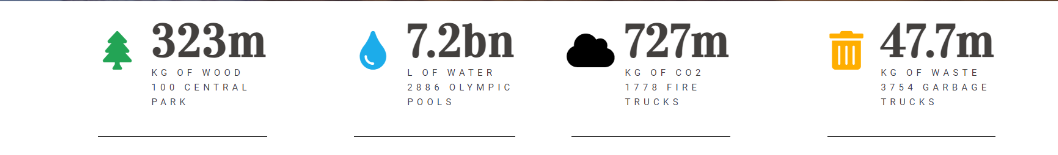

You’ve helped save…

See our previous newsletters below

Visit us

Want to discuss the above face to face? Come visit our specialised team members to find out more.

612 Warrigal Road, East Malvern PO Box 61, Holmesglen, Vic 3148

Call us

Have any questions? Further discussions on the above can be may be held over a telephone appointment.

Contact us

For any and all queries regarding the above, you may contact Concepts & Reuslts by emailing us

DISCLAIMER: Whilst all care is taken in the preparation of the material in this newsletter, the information provided is of a general nature and individuals should seek advice as to their own specific needs. Accordingly, no responsibility for errors or omissions is accepted by Concepts & Results group of companies or any member or employee.