Talking Concepts

March 2024

Computer scams

We have had a lot of reports from clients regarding scams (email, sms and telephone calls). Please take care when you receive an email, sms or telephone call asking you to click on a link or provide information.

NEVER provide information to anyone over the phone who calls you. Ask them to provide a reference number and call the relevant party or provider yourself to confirm if they require the information.

NEVER click on a link in an email or SMS. Contact the relevant party or provider direct.

Check the email address of the sender, if it is a scam it will not be a .au email address and will probably have a weird name.

Please feel free to contact our office if you receive an email or sms that you are unsure of from the ATO or our office.

Here are some links which may help you identify scams from real contacts.

Scam Watch Online Safety Financial Scams Check and report scams ATO

Investment alert list

Australia

International

Dates to Remember

31st March 2024 – FBT

25th April 2024 – ANZAC Day

28th April 2024 – Super Guarantee Contributions

15th May 2024 – Last day for Income Tax Returns lodgements

21st May 2024 – FBT Returns Due – Look out for detailed correspondence sent to you and article below

26th May 2024 – March BAS Due (if ELS lodged with C&R)

30th June 2024 – End of Financial Year

INTEREST RATES

Interest Rates that start from…

5.79% p/a Fixed Rate

6.45% p/a Comparison Rate

Based on our lender panel, Heritage Bank’s 3 Year Fixed Rate, provides the most competitive Interest Rate. Interest rates are correct as at 15/03/2023 and subject to change at anytime. The comparison rate is based on a loan amount of $500,000, over a 30 year term. WARNING: This comparison rate is true only for the example given and may not include all fees and charges. Different terms, fees and other loan amounts might result in a different comparison rate. Terms, conditions, fees and charges apply and your full financial situation would need to be reviewed prior to acceptance of any offer or product

C&R Updates

We’re please to announce that our Admin team have 3 new baby boys to welcome into the world. Bethany Campbell has given birth to a set of beautiful twin boys and, Ashlee Berkec has delivered her adorable baby boy.

Rocky from our Accounting team is also now the proud dad of a beautiful little girl.

Congratulations Bethany, Ashlee & Rocky!

Born: 03/03/2024

Time: 4:30pm

Joseph Walker Camburn

Born: 09/03/2024

Time: 4:38pm

Weight: 4.10kg

Siya Sharma

Born: 07/01/2024

Time: 4:51pm

Weight: 2.55kg

Concepts & Results are happy to welcome Alysia & Mandy to our Admin team! You may have already been introduced to them on the phone or via email.

Proposed Tax Cut Announcement for 2023 / 2024 Financial Year

2024 FBT

On 31 March 2024, the Fringe Benefits Tax (FBT) year ends. With the ever-increasing budget deficits as a result of COVID-19, the ATO will be reviewing whether all employers who should be paying FBT are paying it, and that they are paying the right amount. The ATO has recently announced that the ‘FBT gap’ is now over $1.3 billion and will be deploying resources for FBT compliance to close this gap.

Generally, if you have employees (including Directors) and you provide them with cars, car parking, entertainment (food and drink), employee discounts, loans, or reimburse private expenses, then you are likely to be providing a fringe benefit and we will need to register your business for FBT. There are 13 defined Fringe Benefit categories in the FBT law.

Even though Fringe Benefits Tax (FBT) is designed to capture benefits enjoyed by an employee, it is levied on the employer. Unless your employment agreement allows for any FBT that becomes payable to be recouped from the employee, the employer will have no recourse for reimbursement.

Should you lodge a FBT Return

Even though Fringe Benefits Tax (FBT) is designed to capture benefits enjoyed by an employee, it is levied on the employer. Unless your employment agreement allows for any FBT that becomes payable to be recouped from the employee, the employer will have no recourse for reimbursement.

So, why should an employer lodge an FBT return where no FBT is payable? Well, for the simple reason that it turns on a three-year deadline for the ATO to commence audit activities.

Without an FBT return being lodged, the ATO has the discretion to launch an audit into activities as far back as a business has had employees. Without the evidence (e.g., signed declarations, logbooks, meal entertainment records, etc.) that FBT was NOT payable in each year the ATO is likely to raise FBT liabilities, even where the employee who enjoyed the benefit may no longer work for the business. This makes it impossible for the business to recoup anything from the past employee.

Workhorse vehicles are generally exempt from the car fringe benefit rules, provided they are only used for work related travel including home to work travel and private use of that vehicle is restricted to minor, infrequent and irregular use. For example, irregular dropping off / picking up children to school on the way to / from work. Where the private use is more than minor, infrequent and irregular a residual fringe benefit has been provided and there is a different method to work how much FBT is payable.

A workhorse vehicle is a panel van, utility (ute) or other commercial vehicle (that is, one not designed principally to carry passengers) such as a dual cab ute with a carrying capacity of one tonne or more.

Have you been keeping good SMSF records?

As 2024 begins it's important to maintain good records

Source: ATO. Published 8 February 2024

There are many benefits to applying good record keeping habits for your self-managed super fund (SMSF). It’s also a legal requirement.

The benefits of good recording keeping include:

- making it easier for you to provide information to your SMSF professionals for independent audit and annual return preparation

- helping reduce audit and administration costs

- avoiding the risk of receiving administrative penalties which are personally payable by each individual trustee or the corporate trustee of the fund.

Remember, even if you use a super or tax professional to administer your SMSF, each trustee is still responsible for good record keeping.

Illegal early access to super

Make sure you know when it's legal to access your super – there are consequences if you access it illegally.

Source ATO 8 February 2023

When can you legally access your super?

Generally you can only access your super when you reach preservation age and retire or turn 65 even if you’re still working.

There are very limited circumstances where you can legally access your super early. Eligibility requirements often relate to specific expenses.

It is illegal to access your super for any reason other than when it is allowed by the superannuation law.

Remember, there are only a few reasons to access your super and accessing it early may be illegal.

Illegal early access schemes:

Illegal early access schemes encourage you to withdraw your super before you’re legally entitled to.

Beware of people promoting early access schemes. They might tell you they can help you set up a self-managed super fund (SMSF) to withdraw your super and use it to pay for personal expenses such as Credit Card Debit, buy a house or car or go on a holiday.

If you are approached by someone who tells you to set up an SMSF, check they’re a licensed financial adviser. You can do this on the Australian Securities & Investments Commission (ASIC) website.

Warning Sigs:

Promotors of illegal early access schemes usually:

- tell you to transfer or rollover your super to an SMSF so you can access it

- target vulnerable people, including those who are under financial pressure or unaware of super laws

- claim that you can access your super and put the money towards anything you want

- charge high fees and commissions

- request your identity documents.

How to protect yourself from illegal access schemes:

If someone offers you advice that you can withdraw your super early (other than by legal means):

- Stop any involvement with the scheme, organisation or the person who approached you.

- Do not sign any documents.

- Do not provide them with any of your personal details.

- Phone our office on 9569 5676 or call the ATO on 13 10 20 and advise us of your situation.

Illegally accessing your super will cost you a lot more than the super you withdraw.

You may face significant financial consequences and lose your retirement savings.

Any amount you illegally access will be included as income in your tax return, even if you return it to the fund. This means you may pay additional income tax, tax shortfall penalties & interest.

If you’ve illegally accessed your super you can’t return it back into your fund.

Any attempt to do so will be considered a new contribution.

If you provided fraudulent documents to the ATO or your super fund, you will also be liable for penalties for false and misleading statements.

If a promoter helped you access your super illegally, you can’t claim a personal deduction for fees or commissions they take from your super.

If you participate in a scheme, you may become a victim of identity theft.

This is when someone uses your personal details to commit fraud or other crimes. If someone steals and misuses your identity, they could steal your super for themselves.

If you illegally access your super or have been involved in a scheme promoting illegal early access to your super, contact us immediately. When we consider penalties, we will take your voluntary disclosure and circumstances into account.

Consequences for SMSF Trustees:

If you are an SMSF trustee and you illegally release benefits to a member who has not met a condition of release, you may be liable for administrative penalties.

You may also be disqualified as an SMSF trustee. If disqualified:

– you cannot operate as a trustee of an SMSF

– your name will be published in both the Commonwealth Government Notices Gazette and our trustee disqualification register.

This means your disqualification will be on public record. This can have an adverse impact on you professionally, personally or financially.

Promoters of illegal schemes

The ATO and The Australian Securities & Investments Commission (ASIC) may prosecute promoters of schemes designed to illegally access super. These activities may involve breaches of the following legislation:

– Superannuation Industry (Supervision) Act 1993

– Corporations Act 2001

– Australian Securities and Investments Commission Act 2001.

Breaches may include:

– misleading or deceptive conduct

– giving financial product advice without an Australian financial services licence.

The ATO may impose civil and criminal penalties, including significant fines and terms of imprisonment.

Case study – consequences for a promoter of an illegal access scheme:

A Federal Court imposed a $220,000 penalty and a 7-year ban for the promoter of an illegal early access scheme involving SMSFs.

The ATO, as regulator of the SMSF sector, commenced legal action against the New South Wales woman in 2018 after a tip-off about the suspect establishment of several SMSFs.

She had set up or intended to set up 35 SMSFs on behalf of 68 individuals between 2016 and 2018. She then helped individuals not yet legally entitled to access their super, transfer their balances to their SMSF so they could illegally withdraw it. This sometimes occurred on the same day.

Participants in the scheme reportedly used the money to fund personal expenses including home renovations and stamp duty.

After seeking an initial injunction that placed restrictions on the scheme’s facilitator, the ATO filed an application in the Federal Court seeking declaratory relief, a final injunction and payment of a civil penalty.

This case demonstrates that there are serious consequences for promoters of illegal early access schemes. Super is money set aside to provide for retirement and withdrawing your super without meeting a condition of release can result in long-term financial damage. This can leave people with little or no super for their retirement as well as a significant tax bill on the amount withdrawn

Have you visited our Bookkeeping Department Website yet?

Granny Flats Are Now More Affordable in Victoria

Source: DuoTax

Granny flats, also known as secondary dwellings or backyard studios, have become an increasingly popular housing option across Australia in recent years.

As house prices continue rising out of reach for many families and the cost of living crisis makes its mark, granny flats provide a more affordable way for multiple generations to live together on a single property. They also boost housing density and supply.

However, restrictive planning rules and red tape have previously hindered the development of granny flats in Victoria compared to other states. But finally, there’s some good news.

The Victorian Government’s announcement in December 2023 means Victorians will no longer need a planning permit to build a granny flat under 60 square metres on properties over 300 square metres.

This reform aims to make it easier for families to stay together affordably and address the state’s housing shortage.

This makes more than 700,000 homes across the state potentially eligible for planning approval to build a granny flat on their blocks. As quoted by Premier Jacinta Allan, “We know for many Victorians the burden of planning approvals has put building a small second home in the too hard basket – we’re making it easier, so families can grow together and have a place to care for loved ones.”

So what does this mean for the overall impact on housing affordability and availability? Let’s take a look.

Key Details of the Granny Flats Reform in Victoria

As mentioned above, the recently announced reform removes the requirement for obtaining a planning permit for granny flats in Victoria under 60 square metres built on properties over 300 square metres, effective from December 2023.

Allan noted that by the beginning of 2024, families will no longer need a planning permit to construct a small secondary residence on their property.

The reform applies to any second home less than 60 square metres on blocks exceeding 300 square metres, so long as there are no flooding or environmental risks.

The goal is to make it easier for multi-generational households and provide more affordable housing options, especially as the market continues to make it harder for buyers to make a move.

For plenty of Victorians, this is welcome news. Removing the burden of seeking out planning approvals on construction makes building a second home an accessible option for those who desperately need it.

Allan also noted that it allows families to “grow together and have a place to care for loved ones.”

What’s Still Required

While the planning permit requirement is removed, small second homes will still need building permits (different from planning permits) and must comply with residential design code (ResCode) rules regarding setbacks and siting. They also cannot be subdivided from the main property or sold separately.

What to Consider When Building a Granny Flat

While these changes are exciting, adhering to other regulations like siting and setbacks is still essential to get approval and ensure neighbourhood amenities.

Carefully designing a granny flat in Victoria to complement both the main house and the surrounding community aesthetic is recommended.

Another consideration is financing, as lenders treat granny flats differently than traditional dwellings. For this reason, we always encourage our clients to speak with a mortgage broker familiar with granny flat lending criteria, enabling them to avoid issues.

Keeping utility and infrastructure connections in mind is also critical in planning and budgeting.

Professional guidance is invaluable as building materials and labour costs continue rising in Australia.

With sound planning and support, adding a granny flat in Victoria can be affordable and meet multi-generational housing needs. Just remember to always do your due diligence first!

Key Takeaways

The recently announced planning reforms in Victoria regarding granny flats are a significant step towards enabling multi-generational living and increasing housing supply.

By removing permit requirements for secondary dwellings under 60sqm, the state government aims to reduce barriers for families wishing to stay together affordably.

Early analysis suggests over 700,000 existing lots could be eligible for streamlined granny flat development after these changes.

Careful implementation and review are still necessary to ensure the reforms translate to real gains.

With the right support, the changes can potentially drive a substantial increase in granny flats, benefiting many Victorian families.

Engaging in a cost estimation team can ensure building a granny flat is the right option for you.

How to Compare Landlord Insurance Policies

Source: Duo Insurance

With a wide range of options in the market today, how do you compare landlord insurance to find the right one?

One of the most important things you can do as a landlord is get proper landlord insurance. This protects your rental property and tenants in the event of damage, lawsuits, and loss of rental income.

But not all landlord insurance policies are created equal.

Taking the time to compare policies from different providers thoroughly is crucial to finding the right coverage at the best price. Here’s what to consider.

First, What is a Landlord Insurance Policy?

Landlord insurance is a specific insurance policy designed for property owners who rent out their properties to tenants. It covers various potential issues, including property damage, liability costs, and loss of rental income.

However, the exact coverage depends on the policy and provider.

Key Components of Insurance For Your Investment Property

There are a few key details to consider when taking out landlord insurance coverage.

Building and Contents Cover

Building insurance offers protection for the physical structure of your property, including walls, roofs, and fitted kitchens, among other permanent fixtures. Contents insurance, on the other hand, covers detachable items within the property that you own, such as appliances and furniture.

Rent Default or Loss of Rent Cover

This component covers loss of rental income due to various insured events such as tenant eviction, death of a sole tenant, or failure to pay rent.

Public/ Legal Liability Cover

Public liability insurance covers legal and medical costs associated with injuries on your property.

Legal Costs Cover

Assists with legal fees incurred in evicting a tenant or making a legal claim for rental loss.

Malicious and Accidental Damage Cover

The coverage extends to both intentional (malicious) and unintentional (accidental) damage caused by tenants or their visitors.

Pet Damage Cover

If you allow pets on your property, consider coverage for damage caused by pets.

Disaster Cover

This provides coverage for damages and loss of rent due to natural disasters such as floods or bushfires.

Change of Locks Cover

This covers the cost of changing locks after a claim, such as when a tenant leaves with your keys.

Things to Consider When Comparing Landlord Insurance Cover

Beyond being aware of the components of your policy, there are several coverages and factors you need to consider when looking at different policies to protect your investment property, including the following:

Factors to Consider | Details |

Coverage amount | Make sure the policy has adequate dwelling coverage to completely rebuild your rental property in the event of a total loss. Also, look at the loss of rent coverage limits to cover lost income if the property is uninhabitable. |

Covered risks | Compare named peril policies that cover specific listed risks versus open peril policies that cover all causes of loss except those excluded. Ensure common risks like fire, lightning, theft, water damage, etc. are covered. |

Liability protection | Look at the liability limits to cover injuries, property damage, and lawsuits. Higher limits are better for higher-value properties. |

Loss of rent | Check how much loss-of-rent coverage is included. You want enough to pay the mortgage and expenses during vacancies. |

Deductibles | Lower deductibles mean lower out-of-pocket costs if you file a claim, but also higher premiums. Compare tradeoffs. |

Discounts | Ask about discounts for things like multi-policy bundles, security systems, etc. This can help lower premiums. |

Tips for Comparing Landlord Insurance

When it comes time to get quotes and compare options, keep these tips in mind:

- Use online comparison tools to get multiple quotes side-by-side easily. This allows you to see differences in coverage, limits, and pricing quickly.

- Work with an independent insurance broker who can shop rates from multiple insurers to find you the best deal. Their expertise can be invaluable.

- Don’t assume all policies are equal; ask insurers to explain coverage and limits clearly. Dive into the details.

- Carefully read policy documents, look up definitions of key terms and confirm exclusions. Don’t gloss over the fine print.

- Consider bundling your landlord insurance with other policies like home or auto for multi-policy discounts.

- Look for insurers that offer premium discounts for safety features like smoke detectors, security systems, etc. This can add up over time.

- Pay close attention to loss of rent coverage, liability limits, and rebuilding cost coverage amounts based on your specific property.

Key Takeaways

Finding the right landlord insurance policy takes some work, but it’s worth the effort. The right landlord insurance coverage can give you peace of mind and financial protection in the event of property damage, lawsuits, and loss of rental income. Follow the tips in this article to compare policies and make sure you have:

- Adequate dwelling coverage

- Loss of rent coverage

- Liability protection

- Coverage for common risks.

And be sure to thoroughly compare policies from leading insurers to find the best match for you.

FAQs

What Type of Insurance Do Landlords Need

Landlords need landlord insurance, often called rental property insurance. This protects against property damage, loss of rental income, and liability claims. Standard policies include dwelling coverage, loss of rent coverage, liability coverage, and more. Landlords should look for a policy designed specifically to meet the needs of rental properties.

How Much Dwelling Coverage Should I Get?

Your dwelling coverage limit should equal the full replacement cost to completely rebuild your rental property in the event of a total loss. Factor in construction costs in your area, as well as the size, features, and quality of your property. An insurance agent can help you properly estimate the rebuilding costs. Underestimating can leave you underinsured.

Why is Loss of Rent Coverage Important?

Loss of rent coverage provides reimbursement for lost rental income if your property is uninhabitable due to a covered peril like fire or storm damage. It covers your mortgage, taxes, and other expenses until the property can be repaired. Without it, you’d have to pay these bills out of pocket. Match the limit to your typical monthly expenses multiplied by the estimated repair time.

How Much Does Landlord Insurance Cost?

The premium you pay for landlord insurance can vary quite a bit based on the unique factors assessed by each insurance provider. These include the age and value of the rental property, its location and risk of natural disasters, the type of dwelling, and more. With so many variables, there is no standard “average” cost. But here are some things that impact pricing:

- Older homes or those in high-risk areas will typically cost more to insure. Newer buildings in low-risk locations can have lower premiums.

- Higher property values mean higher rebuild costs, which increase premiums. Lower-valued rentals have lower premium costs.

- Multi-family buildings like apartments carry more risk than standalone homes, increasing insurance rates.

- You can lower your premium by choosing a higher excess but make sure you can afford the out-of-pocket cost if you claim.

- Online discounts, multi-policy bundles, and no-claims bonuses can also help reduce your total insurance costs.

How is Landlord Insurance Different from Home Insurance?

Landlord insurance is designed for rental properties, while home insurance is for owner-occupied residences. Key differences include the following:

- Landlord insurance has higher liability limits to protect against tenant lawsuits. Home insurance usually has lower liability coverage.

- Loss of rent coverage is included in landlord policies but not in standard home insurance.

- Landlord policies use the actual cash value of the personal property, while home insurance pays replacement costs.

- Landlord insurance covers lost income from the property, while home insurance does not.

- Discounts like multi-policy bundles may only apply to home insurance, not landlord coverage.

So, while they share similarities, landlord insurance contains provisions specific to the risks faced by rental properties.

Is Landlord Insurance Tax Deductible?

Yes, landlord insurance premiums are considered a deductible expense for rental properties. When filing your investment property taxes yearly, you can deduct 100% of your landlord insurance payments to lower your taxable rental income. Maintain records of premiums paid to document the deduction.

Is Landlord Insurance a Legal Requirement in Australia?

There is no nationwide law making landlord insurance mandatory in Australia. However, the state of Tasmania does require property owners to carry landlord insurance under the Residential Tenancy Act. Some mortgage lenders may also require you to have a landlord insurance policy if the rental property carries a mortgage loan. While optional in most of Australia, it is still highly recommended to protect your investment.

Have you visited our Loans Department Website yet?

First Home Owner Grant (FHOG):

The Victorian FHOG is a one-time, lump-sum payment offered by the Victorian government to eligible first-time homebuyers who purchase or build a new home in Victoria, Australia.

The grant is designed to assist first-time homebuyers in entering the property market by providing financial support.

Eligibility criteria typically include:

- being an Australian citizen or permanent resident

- and intending to live in the property as your primary residence

- Being at least 18 years old.

- Never having received the FHOG before.

- In Victoria, the FHOG typically applied to new residential properties, which were homes that had not been previously occupied or sold as residential dwellings.

The grant amount and specific eligibility criteria can vary depending on the timing of your application, the property’s value, and other factors.

For new homes in metropolitan Melbourne if the contract was signed on or after July 1, 2017: The FHOG is $10,000.

The property value threshold for new homes in metropolitan Melbourne the threshold is set at $750,000. For new homes in regional Victoria if the contract was signed on or after July 1, 2017: The FHOG is $20,000.

The property value threshold for new homes in regional Victoria, the threshold is set at $600,000.

First Home Loan Deposit Scheme (FHLDS):

The First Home Loan Deposit Scheme is a federal government initiative designed to help eligible first-time homebuyers purchase a home with a smaller deposit, typically as low as 5% of the property’s value, without having to pay for Lenders Mortgage Insurance (LMI).

Unlike the FHOG, which is a grant, the FHLDS is more of a guarantee. It allows eligible buyers to access a home loan with a lower deposit by guaranteeing the additional portion required for a 20% deposit, effectively helping them avoid the cost of LMI.

Eligibility criteria for the FHLDS include:

- Income thresholds: income thresholds for singles and couples in Victoria as follows:

- Singles: Maximum income threshold $125,000 per year.

- Couples: Maximum combined income threshold $200,000 per year.

- property price caps,

- being a first-time homebuyer.

- location of property and other factors.

The FHLDS is a federal program, so it is not specific to Victoria but applies to eligible buyers across Australia.

It’s crucial to note that these programs are subject to change, and their terms and conditions may have evolved since my last update in September 2021.

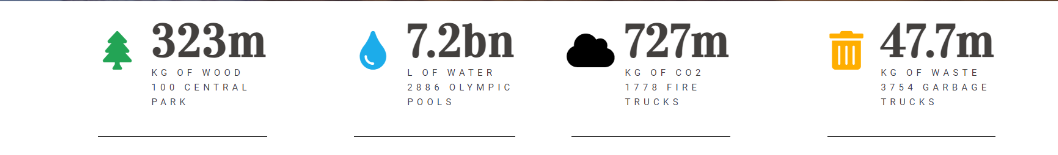

Electronic Signing

At Concepts & Results we ask you to sign documents electronically whenever possible. This can be via Xero, Docusign, or Adobe sign. You’ve helped save…

See our previous newsletters below

Visit us

Want to discuss the above face to face? Come visit our specialised team members to find out more.

612 Warrigal Road, East Malvern PO Box 61, Holmesglen, Vic 3148

Call us

Have any questions? Further discussions on the above can be may be held over a telephone appointment.

Contact us

For any and all queries regarding the above, you may contact Concepts & Reuslts by emailing us

DISCLAIMER: Whilst all care is taken in the preparation of the material in this newsletter, the information provided is of a general nature and individuals should seek advice as to their own specific needs. Accordingly, no responsibility for errors or omissions is accepted by Concepts & Results group of companies or any member or employee.