“This article has been produced in association with our lawyers and specialist asset protection and estate planning advisers, Abbott & Mourly”

Introduction

Building Family Wealth takes time, hard work and a lot of blood, sweat and tears. But it can be torn down so easily in expensive litigation, legal challenges plus regulatory and economic threats. It is not unheard of for a $1M deceased person’s estate to be challenged and when that happens expect upward of $200,000 in legal fees and years of litigation. The bigger the estate the larger the fees. And anyone with a business or profession, from a doctor advising patients to a property developer with their latest project to a hairdresser who may have spread Covid to clients, they may be exposed to lengthy and costly lawsuits.

This does not have to happen!

Family Wealth - Is Yours Protected?

There are five ways that family wealth can be attacked – each a potential time bomb on a family’s wealth and health.

(i) Litigation

We are living in an era where our employees, children, spouses, neighbours, government, councils, tenants and regulators can sue you and there is no end of No Win No Fee lawyers ready to take up the case. You may not know it, but Australia produces more law students per capita than any other nation on earth. That is why Australia has a very strong legal industry that earns more than $23Bn in revenue each year and even managed investment vehicles enabling investors to pool money together to invest in class action litigation. EXPOSED: Assets of any kind in your own name are exposed in a litigation action. The biggest threat is not the litigation, but the time taken in the legal system, the stress and the sheer amount of legal fees that can easily escalate in any litigation.

(ii) Incapacity

Where a person suffers from mental incapacity then they cannot be a trustee or director of a company. And what we have learned with Covid, is that a medical event can put a person out of action for some time. • What happens if they are the sole director or a director of a trustee company for a discretionary trust or a SMSF? • Who is going to run the show? Without any strategic solution put in place prior to the incapacity, any business, trust, super fund or investment is at peril as the family wealth ship cruises into unchartered waters without a captain or rudder. EXPOSED: Assets, investments, companies, trusts, super funds are exposed where a key person, director or trustee become incapacitated.

(iii) Bankruptcy

For many business owners and professionals Covid has had an impact on their income and the strength of their business or career. We are moving into unchartered waters and many insolvency practitioners are talking about the significant uptick in their business – at the expense of family wealth. It is heartbreaking to see family businesses go to the wall through government lockdowns and actions with no protection in place. EXPOSED: Assets, investments, companies, trusts and even superfunds are exposed where a key person, director or trustee is in the throes of insolvency or bankruptcy.

(iv) Death

On death most people who have a Will would expect that all of their personal assets, including home, investments and superannuation would be paid out in accordance with their Will. Wrong!!! Every State in Australia allows a disaffected person (someone who did not benefit from a Will or obtain what they believe they deserved) to claim against an estate. Any claim overrides the provisions of a Will. A Real Case in Point: A family provision claim on estate assets may result in long and costly court proceedings. In Western Australia in 2018 the judge of the WA Supreme Court castigated lawyers who had taken five years and $500,000 in legal fees to challenge a $600,000 estate consisting only of the deceased’s home. This is happening every day in Supreme Courts around Australia and that should not happen to you. Your choice of what to do with your family’s assets should be your choice, not the choice of a Supreme Court judge looking for the person who needs the assets. EXPOSED: Assets, investments, companies, trusts, super funds are exposed to family provisions litigation where a key person, director or trustee dies.

(v) Family Law

Most people are not aware that a simple de-facto relationship that has lasted two years means both parties of the relationship, in the event of a relationship breakdown, have full recourse against the other’s property under the Family Law Act in Australia. Giving adult children money, inheritances, help with purchasing a property, or having an unpaid present entitlement in a family trust may add fuel to the fire in a relationship breakdown. The same with marriage and more so, with second and third marriages. The old asset protection strategy of putting assets in a spouse’s name to protect from litigation can be a disaster in the making from a Family Law perspective. EXPOSED: The Family Law Court has supreme powers to split all assets, investments, companies, trusts and super funds in a relationship breakdown.

Solution - The Protector

Lawyers and specialist asset protection and estate planning advisers, Abbott & Mourly have developed “The Protector”, a family wealth protection package, which available to us at Concepts & Results, which not only provides asset protection, but ensures that your assets are held for the benefit of those beneficiaries in your lineage or bloodline that you want. This will ensure that your assets are kept in the hands of your lineage.

Let’s go through each of the steps of The Protector so you understand why and how it works.

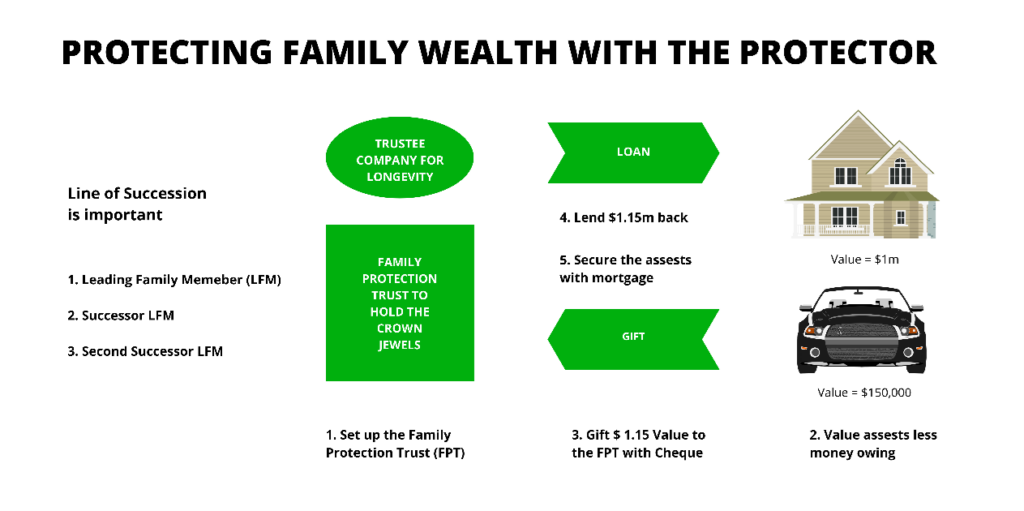

1. Establish a Family Protection Trust

A trust can be a great vehicle, if structured properly to protect assets, a business, investments and family wealth as well as to look after bloodline lineage. However, if not structured properly, it can be a disaster in the making. The Protector uses a special purpose Trust for the beneficiaries of your lineage or bloodline that you desire, including yourself and your spouse. If you have an existing trust this may prove suitable unless it is also potentially openly exposed because it runs a business or service.

The key person in the Trust is not the Trustee but the Family Protection Appointor who can control who is a beneficiary as well as who is Trustee. With family in mind and longevity, succession is the key. How are we going to pass and protect family wealth for the benefit of future generations? This requires building a line of succession of Family Protection Appointors (FPA). If a FPA comes under attack legally, becomes incapacitated or dies then the next line FPA takes automatic control ensuring the security and strength of the Trust.

A crucial feature of the trust set up is having a corporate trustee to match the longevity of the trust structure. As assets are to be in the name of the trustee, having individuals is administratively problematic but also raises concerns if they are sued, become incapacitated or die. On the other hand, a company lives on forever with directors moving in an out of the corporate trustee. There are also other strategic reasons for having a company including the orderly transition between FPA controllers as the FPA is the only holder of the trustee company shares.

2. Calculate Family Wealth

The Australian tax system provides tax advantages if you hold, in your own name, a family home (no capital gains tax – CGT) or negatively geared investment properties (tax deductions for interest and 50% CGT discount). The same goes for shares and other investments. BUT as we have learned, while in personal names these assets are exposed.

If possible, we want to protect assets by transferring then into the Family Protection Trust by way of gift but not all assets as there could be tax issues. There is no gift tax in Australia, however, the Family Protection Trust is a separate entity or person, so any gift of an asset involves a change in ownership. This means that we only want to transfer shares or other assets into the trust provided:

i) There is no capital gains tax or other taxation issues

ii) There are no stamp duties or other State taxes.

However, a lot of assets, particularly property cannot be transferred to the Family Protection Trust without capital gains tax and stamp duties, which we do not want to pay – even though protection of family wealth is all important. Instead – we do not transfer the assets but only their underlying value. This is done by way of a gift as Australia does not have a gift tax. The way it works is like this: we determine the valuation of all assets in a person’s legal name which may include the family home, investment properties, cars, jewellery, private company shares, investments, unit trusts and other assets. Then we deduct any loans or borrowings on those assets to determine the new wealth or net equity that the legal owner of the assets has across their entire asset portfolio.

3. Gift Net Wealth to the Family Protection Trust

Once the net wealth or equity value in all the owner’s assets is determined, this is then gifted to the Trust using a cheque like instrument called a promissory note – also known as a legal IOU. Once this is done the person gifting the net equity still owns all the assets, there is no transfer remember, but their personal wealth has been reduced to zero or a very low number. This is where the protection comes from.

4. Loan to Asset Owners

If the asset owners wish to continue to use the property then the trustee of the Family Protection Trust will lend the corresponding net equity in the gifted assets back to the legal title holders of the assets (the original gifter). This is the same as what happens with a bank when you buy a home. You buy the home using borrowed monies from the bank and the bank lets you use the home provided you continue to service the loan.

5. Securing the Loan

Just like a bank it is crucial for the trustee of the Family Protection Trust to secure the loan by registering a mortgage over all real estate. If a bank currently holds a mortgage on the property, the Trustee will hold a second mortgage and may be required by the bank to complete a Deed of Priority ensuing the bank retains first mortgage rights.

For any personal property like shares, cars, jewellery, collectibles and other

assets these can be secured through the governments Personal Property

Securities Register. We have specialists that can register mortgages and lodge PPSR registration on behalf of the Trustee. Feel free to contact us to arrange this service.

6. Special use of call option

Over time assets may increase in value which would require an on-going gift loan back of the increased value over time. An alternative is for the legal owner to offer a call option to the Trustee of the Family Protection Trust. The way it works is the Trustee and the owner enter into an option agreement where the Trustee has the ability to acquire, by way of purchase the assets for an amount equal to their market value at the time of the option.

For example, John Smith owns a house worth $1M with a $200,000 bank mortgage. John has set up the Smith Family Protection Trust and gifted the net equity in his home – $800,000 into the Trust which has been lent back to John and secured a second mortgage. John enters into a call option agreement with the Trustee, who pays $100 for the option to acquire the property at some time in the future for $1M. If the property goes down in value, then the Trustee loses its $100. But if the property goes up to $1.2M then the value of the option is now $200,000 (less its cost). The key element here is that the increased value has gone to the Trustee.

What to do Next?

The Protector is only one solution to protecting your Family Wealth against the Big Five exposures but it is a vital step and it is crucial to start it, well yesterday. Who could not benefit from having a Family Wealth Protection solution in place – even if it is only for your family home?

To get things rolling complete the attached Data Capture and send it back to us so we can set up an appointment, review your family succession requirements and more importantly get into action. We will provide a fixed cost quote depending on what is required but there is no out of pocket costs for a review and the initial appointment.

Don’t delay and get the weight lifted off your shoulders now. If you would like to watch a video that Grant Abbott of Grant Abbott from Abbott & Mourly Lawyers and the Chairman of the Succession, Asset Protection and Estate Planning Advisers Association, discussing the Protector – please click here: Grant Abbott’s Protector Video

Download attachment: Data Capture